개인회생

개인회생은 더 이상 빚을 갚을 능력이 없는 상태에 있는 사람이 일정한 소득이 발생하는 경우 3~5년 동안 일정한 금액만 갚으면 채무를 모두 면제해주는 제도 입니다.

이러한 제도를 불공평한 제도라고 생각하는 분들도 있는데, 개인회생을 통해 더 이상 삶을 영위하기 힘든 분들에게 마지막 도움이 될 수 있습니다.

개인회생 대상자

개인회생 대상자는 급여소득자나 영업소득자처럼 매달 일정한 금액의 소득이 있어야 합니다. 여기서 소득은 연금, 사업소득, 근로소득 등 매달 정기적으로 확실한 수익을 얻는 걸 말합니다.

채무 총액은 담보가 없는 경우 5억, 담보부 채무의 경우 10억을 넘지 않아야 하는데 이 금액을 초과하는 경우에는 일반회생을 진행해야 합니다.

더불어, 부동산이나 예금 등 소유하고 있는 재산보다 채무가 많아야 하고 종래 면책결정을 받았었다면 5년이 지난 후에나 신청이 가능합니다.

채권자의 동의가 없어도 조건을 충족하면 진행가능한 개인회생은 사채나 조세 등 모든 채무에 관한 조정이 가능하기에, 받을 수만 있다면 큰 도움이 되는 제도입니다.

| 신청자격 | – 매달 월급이나 사업소득 등 정기 수입이 있는 급여소득자 또는 영업소득자 – 채무보다 소유한 재산이 많아야 함 |

| 채무한도 | 무담보 채무 5억원 이하, 담보부 채무 10억원 이하 |

| 변제기간 | 최장 5년 |

| 채권자 결의 | 필요 없음 |

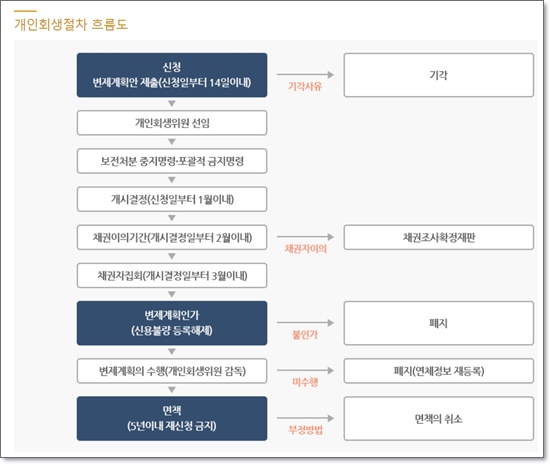

개인회생 진행절차

개인회생 신청 시 신청서를 채무자의 주소지 관할 지방법원 본원에 제출해야 하는데, 주소지가 서울인 경우에는 서울회생법원에 제출해야 합니다.

이 때 3만원의 정부수입인지를 신청서에 붙여야 하고 채권자 수에 따른 송달료도 추가로 납부할 필요가 있으니 참고하시기 바랍니다.

첨부서류도 제출해야 하는데 재산목록, 소득금액증명원, 주민등록등본 등 다양하며 신청자 개인별로 차이가 있을 수 있어서 문의하여 정확한 안내를 받는게 좋습니다.

대한법률구조공단에서는 무료로 법률상담을 진행하여 법을 잘모르거나 경제적으로 부담되어 따로 알아보기 어려운 분들을 지원하고 있습니다.

국번없이 132로 연락하면 안내받을 수 있으니 관련 고민이 있다면 혼자 고민하지 말고 도움을 받아 보시기 바랍니다. 참고로 휴대폰은 02-132로 전화하면 됩니다.

| 법원 | 대표전화 |

| 서울회생법원 | 02-530-1114 |

| 의정부지방법원 | 031-828-0114 |

| 인천지방법원 | 032-860-1113~4 |

| 수원지방법원 | 031-210-1114~5 |

| 춘천지방법원 | 033-259-9000 |

| 강릉지원 | 033-640-1000 |

| 대전지방법원 | 042-470-1114 |

| 청주지방법원 | 043-249-7114~5 |

| 대구지방법원 | 053-757-6600 |

| 부산지방법원 | 051-590-1114 |

| 울산지방법원 | 052-216-8000 |

| 창원지방법원 | 055-266-2200 |

| 광주지방법원 | 062-239-1114 |

| 전주지방법원 | 063-259-5400 |

| 제주지방법원 | 064-729-2000 |